Pros and cons of commercial real estate in Dubai

In 2025, Dubai continues to attract investors not only in residential but also in commercial real estate. Ambitious construction projects, tax haven status, and the emirate’s advantageous geographic location make it an attractive investment destination. However, like any high-yield asset, such investments require a balanced approach.

Let’s analyze the key pros and cons of commercial real estate in Dubai.

Potentially high rental yield

The emirate is known for strong demand for commercial properties, especially in sectors such as retail, office spaces, warehouses, and hospitality. Rental returns in Dubai’s central business districts can significantly exceed those in many developed countries.

No taxes

Confirmed: there is no income tax, no tax on rental profits, no capital gains tax on sales, no property tax, etc. This leads to a substantial increase in net profit for the investor.

Variety of properties

Dubai offers a wide range of real estate: from small units like offices in business parks to large assets. The market includes properties fitting various budgets and investment strategies, including increasingly popular coworking spaces, fulfillment centers, and data centers.

Location

Dubai’s strategic geographic position makes it attractive for international companies seeking to expand their business.

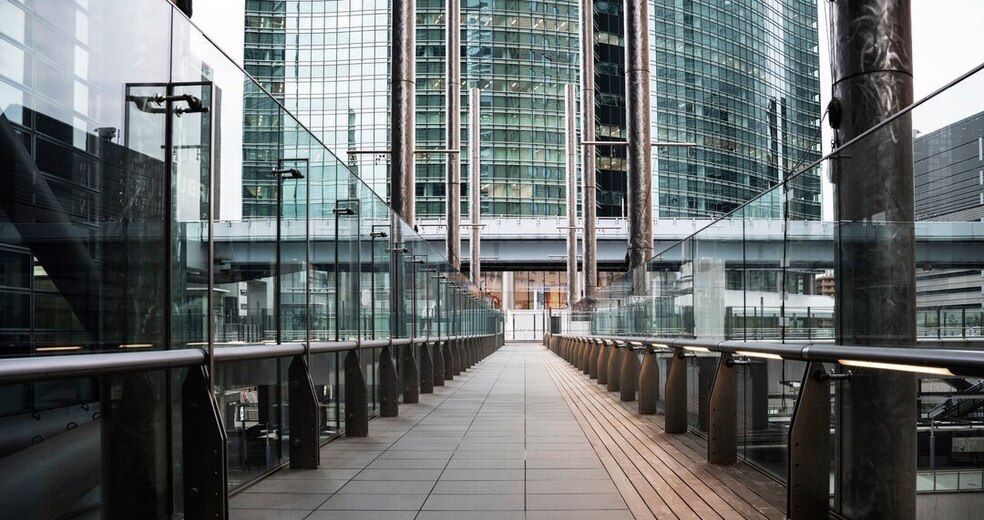

Modern infrastructure

The emirate continues to actively invest in infrastructure improvements, including advanced transport systems (metro, road expansions), telecommunications, smart technologies, and sustainable development. This facilitates access to commercial properties, enhancing their appeal to tenants.

Transparent legislation

Dubai provides favorable conditions for protecting investor rights and stable business operations. For example, property laws guarantee foreign ownership rights in designated zones (freehold, leasehold). Purchasing procedures via DLD are streamlined, and transaction security is ensured through escrow accounts and other protection mechanisms.

Cons of commercial real estate in Dubai

Dependence on global economic factors

Dubai’s real estate market is influenced by the global economy. Oil price fluctuations, geopolitical risks, and recessions can significantly affect demand and investment volumes.

High initial costs

Prices for quality commercial properties in prestigious locations like Downtown Dubai, Business Bay, or Dubai Marina can be quite high. Additionally, annual maintenance fees (air conditioning, cleaning, security) can sometimes be substantial.

Complexity in administration and tenant search

Managing a commercial property independently can be challenging. In new districts or with an oversupply in certain segments, vacancy periods may occur, reducing profitability.

Critical role of location

Choosing the right location is a key success factor. Poor location can lead to low occupancy and consequently lower rental returns.

High competition

Investors need thorough market analysis and smart property selection to stand out among other offerings.

Checklist before investing in commercial real estate

Study the specific segment (offices/retail/warehouses/hotels), location, current and projected rental rates.

Check land status, zoning, encumbrances. Involve a lawyer for this.

Calculate all costs (purchase, registration fees, service charges, management, property transfer tax, expected income, payback period). Consider possible vacancy periods.

Find a management company. A reliable management partner is critical to minimize vacancy risks and ensure stable income.

Remember the market is volatile. Invest with a horizon of 5–7 years to offset short-term fluctuations and benefit from capital appreciation.

.jpg)